While the housing market is rebounding, many people in Kansas City are still struggling to make their mortgage payments. Thankfully, there are a number of things that you can do to avoid foreclosure in Kansas City, and it’s important to remember that acting fast is absolutely paramount to saving your credit score and your home to avoid foreclosure in Kansas City.

If your home is underwater or you have trouble keeping up with your monthly mortgage payments, you may start getting fearful at the fact that your mortgage provider could foreclose on your home.

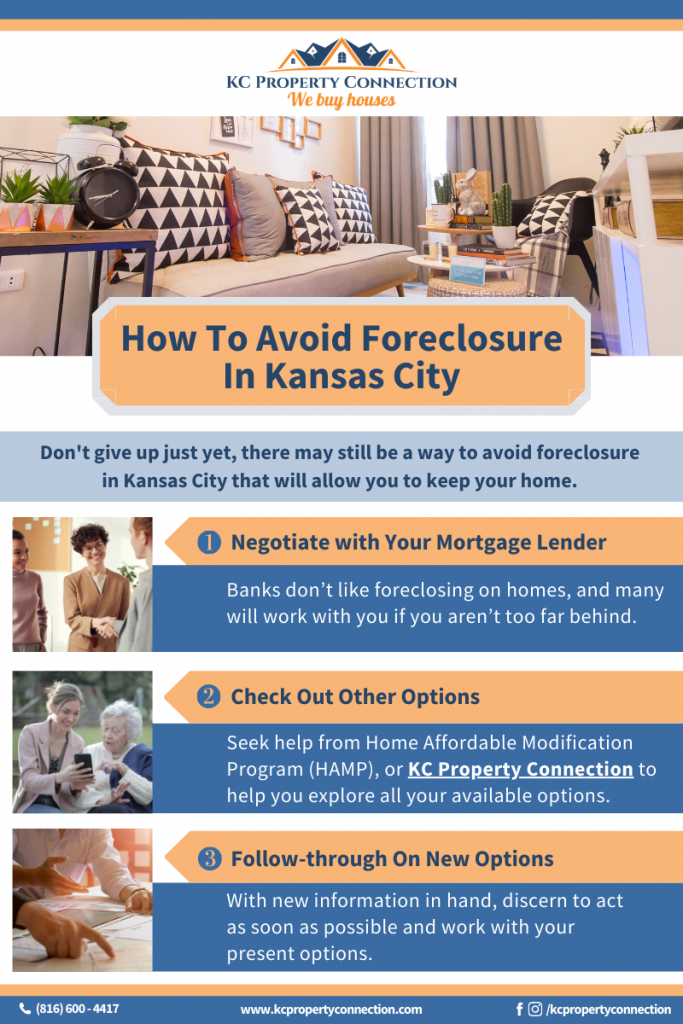

So let’s dive in on a couple of quick tips on how to avoid foreclosure on your home possibly.

How to Avoid Foreclosure in Kansas City:

Do Not Abandon Ship

Many people simply give up and walk away from their homes, not thinking that there are other possibilities that could help stop foreclosure in Kansas City. There are even areas in Kansas City that have begun to look like ghost towns as the economy has impacted residents significantly. Detroit is a prime example of what can happen when people abandon their homes – people unwantedly up and left due to the mortgage crisis in 2008.

This can be a stressful situation, but it’s extremely important to keep your wits about yourself. A foreclosure will have a huge negative impact on your credit score and will likely prevent you from purchasing a home for years to come. If you sell your home, you could leave a portion of the loan unpaid, and the lender could pursue legal action against you for the unpaid portion.

While it’s extremely stressful, you do have options:

• Negotiate with your mortgage lender. Banks and other financial institutions are well aware that the citizens of Kansas City are struggling. If you haven’t missed a payment yet, you may have some leverage to renegotiate the terms of your loan. Banks don’t like foreclosing on homes, and many will work with you if you aren’t too far behind. You may be offered forbearance or even a full loan modification.

• Ask Uncle Sam for help. Over the last five years, the federal government has implemented a number of programs to help struggling homeowners. The Home Affordable Modification Program (HAMP) allows struggling homeowners to modify their loans, reducing monthly payments. The Home Affordable Refinance Program allows homeowners who are current on their mortgage payments to refinance an adjustable-rate mortgage into a low-interest, fixed-rate loan. Both of these programs are subject to eligibility requirements.

• Follow through on your new options. After getting a possible solution to your oncoming foreclosure, make sure to follow through on the things that need to be fulfilled from your end to help speed up the status of your foreclosure and perhaps even stop foreclosure in Kansas City. Whether it’s just getting in touch with the bank for another negotiation process or getting in touch with a home buyer like KC Property Connection to explore other options for your property.

A foreclosure does not define you financially.

Michelle Singletary

We understand that the possibility of losing your home can be stressful. You aren’t alone. Citizens all over Kansas City are going through the same troubles. Foreclosure can have a lasting effect on your financial life, and it’s important to move quickly and take advantage of any options available. You could save both your credit rating and remain in your home.

We may be able to help you as there are a number of things you can do to avoid foreclosure in Kansas City. Connect with us today and let’s discuss your situation. We don’t charge any fees to evaluate the situation, we simply present you with your options so you can move forward and get this foreclosure behind you.

Reasons For Foreclosure In Kansas City, Mo

Foreclosure is a problem faced by many homeowners in Kansas City, Missouri. A variety of factors, such as job loss, unexpected medical bills, or other financial hardships, can cause it.

In addition to these common reasons for foreclosure, some other possible causes include an adjustment to higher mortgage payments due to an interest rate increase, extenuating circumstances such as divorce or death of a spouse, and being overextended on credit card debt. These situations can make it increasingly difficult for homeowners in Kansas City to make their mortgage payments each month and eventually lead them into foreclosure.

It is important for those experiencing financial hardship to know that there are strategies available to help prevent this from happening.

Understanding The Foreclosure Process

When facing foreclosure in Kansas City, Missouri, it is important to understand how the process works. Foreclosure occurs when a homeowner fails to make their mortgage payments, and the lender takes possession of the property.

The process begins with a notice of default from the lender, followed by a period of time when they attempt to collect payment. If payments are not made during this time, the lender will start foreclosure proceedings.

During these proceedings, a homeowner may be able to work out an agreement with their lender or enter into a pre-foreclosure sale. It is also possible for homeowners who are unable to make payments on their loans to obtain assistance through government programs such as HAMP or HAFA.

Lastly, if all else fails and foreclosure is unavoidable, homeowners should look into deed in lieu of foreclosure and short sale options, which may help them avoid some of the financial damage associated with foreclosure. Understanding these strategies can give homeowners more power when facing foreclosure in Kansas City, Missouri.

Strategies To Avoid Foreclosure In Kansas City

When facing foreclosure in Kansas City, Missouri, it is important to know what strategies can be used to potentially avoid losing your home. Working with a qualified loan officer or mortgage broker can be the first step in finding a solution to avoiding foreclosure.

They have the experience and knowledge of current loan programs available that could help you keep your home. Additionally, you should contact a HUD-approved housing counselor who can provide free assistance on working out an affordable repayment plan with your lender or offer advice about other potential solutions such as forbearance or loan modification.

Selling your home is another option that could help you avoid foreclosure and keep some of the money from the sale for yourself. You may also be able to transfer ownership of your property to someone else through a deed-in-lieu of foreclosure or through a short sale.

Lastly, filing for bankruptcy may also give you more time to work out an agreement with your lender and should always be discussed with an experienced bankruptcy attorney before taking action.

Exploring Home Mortgage Options In Kansas City

When facing foreclosure in Kansas City, Missouri, it is important to explore all home mortgage options. Before making any decisions, homeowners should make sure they understand their current financial situation and the options available.

Refinancing can be a great way to reduce the payments due each month and avoid foreclosure. Homeowners may also consider loan modifications that can lower monthly payments or extend the loan term.

If refinancing or loan modifications are not an option, a Home Affordable Foreclosure Alternatives (HAFA) program may be available to help borrowers transition out of their homes and into more affordable housing. Another option is a short sale, which allows homeowners to sell their property for less than what is owed on the mortgage and avoid foreclosure.

Lastly, if facing foreclosure isn’t an immediate necessity, homeowners may consider renting out their home as an income source while keeping ownership of the property. Exploring these different home mortgage options in Kansas City can help homeowners avoid foreclosure and ultimately stay in their homes.

Steps To Stop Foreclosure In Kansas City

Taking steps to stop foreclosure in Kansas City is essential for those who are struggling financially. It can be difficult to navigate the legal and financial process, but there are a few strategies that may help.

One option is to contact your lender as soon as possible. They may be willing to alter the terms of your loan or offer other payment options.

Additionally, you should carefully review your finances and create a budget that fits within your means. It’s also wise to look into government assistance programs available in Missouri.

These could provide temporary relief from payments or even help with long-term solutions like refinancing or loan modification. Other options include working with a credit counseling agency or considering alternatives such as renting out part of your home or selling it yourself.

Taking action quickly and exploring all of these avenues is the best way to avoid foreclosure in Kansas City and protect your financial future.

Bankruptcy As A Means Of Stopping Foreclosure

Bankruptcy is a viable option for those in the Kansas City, Missouri, area who are struggling to make their mortgage payments and don’t want to face foreclosure. In filing for bankruptcy, it can provide a person with a chance to reorganize their debt and stop foreclosure proceedings.

It is important to understand that bankruptcy should be used as a last resort when all other options have been exhausted. When filing for bankruptcy, the court will decide whether or not the debtor can keep certain assets and debts that are part of their estate.

The type of bankruptcy chosen will affect what portion of debts can be discharged or restructured. Chapter 7 Bankruptcy allows most unsecured debt, such as credit cards, medical bills, and personal loans, to be discharged in full while also halting any impending foreclosure proceedings.

Chapter 13 Bankruptcy allows individuals to catch up on missed payments and restructure their mortgage debt over time while also stopping foreclosure. Individuals should carefully consider their situation before deciding which type of bankruptcy is best suited for them.

Filing for bankruptcy is no easy task, and it requires an understanding of the financial ramifications that come along with it, such as credit score damage and court fees.

Impact Of Foreclosures On Property Values

Foreclosures in Kansas City, Missouri, can have a negative impact on the value of property in the area. When a home is foreclosed, it can lead to slow market activity and decreased property values.

This can be especially true if there are multiple homes in close proximity that have been foreclosed upon. Not only does this hurt the neighborhood housing market, but it can also decrease the value of surrounding homes.

One way to prevent this from happening is by taking proactive steps to avoid foreclosure. By implementing five strategies such as budgeting, creating an emergency fund, refinancing, understanding loan options, and seeking professional help when needed, homeowners can protect their investments and reduce the risk of foreclosure while also minimizing its effects on property values.

Laws Regulating Foreclosures In Kansas

The state of Missouri has laws in place to protect homeowners from foreclosure. In Kansas City, these laws help ensure that homeowners are given the best chance possible to make their mortgage payments on time and avoid foreclosure.

The laws require lenders to provide borrowers with a written notice at least 30 days prior to filing a foreclosure action. This notice must include the name of the lender, the amount owed, and an explanation of how payment may be made.

Additionally, lenders are required to follow certain procedures when processing foreclosures, such as providing a written notice of sale at least 14 days before the sale date and allowing borrowers a right of redemption after the sale has taken place. It is also important for homeowners to understand that they have rights under federal law if their loan is owned by Fannie Mae or Freddie Mac, such as the right to request a loan modification or forbearance.

By understanding these regulations and working closely with their lender, homeowners in Kansas City may be able to prevent foreclosure and keep their homes.

Assessing Risks And Rewards Of Foreclosure Prevention Measures

When it comes to avoiding foreclosure in Kansas City, Missouri, homeowners should take the time to assess the risks and rewards of different foreclosure prevention measures. Taking a proactive approach can help homeowners make more informed decisions about their financial future.

A few strategies that can be used to avoid foreclosure include refinancing or modifying an existing loan, applying for a loan forbearance period, negotiating with lenders and creditors, exploring debt consolidation or bankruptcy options, and seeking the help of a HUD-approved housing counselor. Refinancing or loan modification may require additional fees and costs but could also result in lower monthly payments.

Applying for a forbearance period involves temporarily suspending or reducing mortgage payments for a set period of time when faced with financial hardship. Negotiating with lenders can be beneficial if done correctly and could possibly reduce the amount owed on a loan.

Debt consolidation is an option to pay off multiple debts with one lower monthly payment while bankruptcy is an extreme step that should only be taken as a last resort when all other options have been exhausted. A HUD-approved housing counselor can provide sound advice on which solution would best fit each individual situation.

Short Sales And Deed-in-lieu Of Foreclosure Explained

When facing foreclosure in Kansas City, Missouri, two strategies to consider are short sales and deed-in-lieu of foreclosure. Short sales occur when a homeowner who is unable to pay their mortgage sells their property for less than the amount they owe on the loan.

During this process, the lender agrees to accept the sale price as full payment for the loan balance. This option allows homeowners to avoid foreclosure while also helping them erase their debt obligation.

A deed-in-lieu of foreclosure is another alternative for those struggling with mortgage payments. Through this strategy, homeowners transfer ownership of their home directly to the lender in exchange for a release from all obligations associated with the property.

It is important to note that both short sales and deed-in-lieu of foreclosure can negatively affect one’s credit score and ability to obtain future loans; however, these strategies may be preferable to being foreclosed upon due to the potential financial losses associated with it.

Identifying Signs Of Trouble When Facing Possible Foreclosure

Knowing the signs of impending foreclosure is the first step toward avoiding it. In Kansas City, Missouri, homeowners should be aware of several warning signs that indicate trouble.

One of the most important is a missed mortgage payment. If you are having difficulty making your mortgage payments on time, you should immediately contact your lender to discuss alternate repayment arrangements.

Another sign is an increase in credit card debt or other loans. This may be an indication that you are using alternative methods to cover your mortgage payments and are unable to keep up with them.

Additionally, if you have received a notice from your lender about late payments or defaulting on your loan, this could also be a warning sign. Lastly, if you receive communication from a foreclosure attorney or begin to receive mailings from other lenders offering refinancing options, this can be an indicator that foreclosure may be imminent unless action is taken quickly.

By recognizing these warning signs early, homeowners in Kansas City, Missouri, can take measures to avoid foreclosure and protect their financial future.

Overview Of Pre-foreclosure Notices Issued By Banks

When a homeowner is in danger of foreclosure, banks in Kansas City, Missouri, will typically issue a pre-foreclosure notice. This document serves as a warning to the homeowner that they must take action to prevent their home from being foreclosed on.

The pre-foreclosure notice will outline the terms of the delinquency and provide details about potential strategies for avoiding foreclosure. Understanding what options are available can help homeowners take the necessary steps to protect their homes from foreclosure.

One such strategy is negotiating with the bank to modify an existing loan or refinance it with better terms. Homeowners may also be able to reduce monthly payments by consolidating debt or refinancing into a shorter loan term.

Homeowners should also consider selling their home if they have enough equity and can find a buyer quickly. Selling the house may provide enough money to pay off all outstanding debts and avoid foreclosure altogether.

Additionally, homeowners who qualify for government programs like HAMP and HARP may be able to get assistance with mortgage payments and avoid foreclosure through these programs. Finally, Kansas City homeowners should speak with housing counselors for advice on navigating various options for avoiding foreclosure.

How Can We Prevent Foreclosure In Missouri?

When facing foreclosure in Kansas City, Missouri, it is important to understand the various strategies that can be used to avoid the situation. Here are five steps that can be taken to prevent foreclosure: 1) Explore loan modification options – Many lenders offer loan modification programs that can help bring payments down to an affordable level. 2) Negotiate a repayment plan with your lender – Working out a repayment plan with your lender directly is one of the best ways to avoid foreclosure. 3) Catch up on missed payments – If you have missed payments, you may be able to make them up in order to bring yourself back into good standing.

4) Take advantage of state-sponsored foreclosure prevention programs – The Missouri Housing Development Commission offers several programs designed to help homeowners in need of assistance. 5) Consider selling or refinancing – Selling your property or refinancing could help you get out from under an unmanageable mortgage payment and avoid foreclosure.

Taking action quickly and exploring all available options is key when it comes to preventing foreclosure in Kansas City, Missouri.

What Is The Best Way To Prevent Foreclosure?

The best way to prevent foreclosure in Kansas City, Missouri, is to take proactive steps before it becomes a reality. Here are five strategies for avoiding foreclosure: 1) Evaluate your budget and reduce expenses – Review your income and expenses to determine if you can reduce costs and free up additional funds for mortgage payments. 2) Communicate with your lender – Contact your lender as soon as you know you will have difficulty making a payment. They may be able to adjust the terms of the loan or offer a forbearance.

3) Explore other options – Consider refinancing, loan modification, or a short sale to avoid foreclosure. 4) Seek assistance from a HUD-approved counseling agency – A HUD-certified housing counselor can provide financial assistance and guidance while helping you find solutions to prevent foreclosure.

5) File for bankruptcy – Although this should be used as a last resort, filing for bankruptcy can help stop the foreclosure process, giving you more time to explore other options. Taking these proactive steps can help stave off the potential devastation of losing your home due to foreclosure in Kansas City, Missouri.

What Is The Simplest Solution For A Foreclosure?

The simplest solution for a foreclosure is to take proactive steps to avoid it. Here are five strategies that can help homeowners in Kansas City, Missouri, prevent foreclosure: 1) Make sure your mortgage payments are current. Staying on top of your mortgage payments is the most effective way to avoid foreclosure. 2) Create and follow a budget. Developing a budget and sticking to it can help you stay on top of your mortgage payments and other expenses more easily. 3) Contact your lender if you’re having trouble making payments. Working with your lender to create an alternate payment plan or extend the length of the loan can help you avoid foreclosure in Kansas City, Missouri.

4) Consult with a housing counselor. A housing counselor can provide valuable information about available options to keep you in your home, such as refinancing or modification of the loan terms. 5) Sell the property before the foreclosure process begins.

If selling is not possible, consider renting out the property while continuing to make regular payments on the mortgage loan until financial stability is achieved. By utilizing these strategies, homeowners in Kansas City, Missouri, can prevent foreclosure and keep their homes.

How Long Can You Live In Your House Without Paying Mortgage?

If you are facing foreclosure in Kansas City, Missouri, it can be a difficult and overwhelming process. Knowing how long you can live in your house without paying a mortgage is an important factor in avoiding foreclosure. Fortunately, there are several strategies that homeowners can take to prevent or delay the foreclosure process. Here are five strategies to avoid foreclosure and maximize the amount of time you may be able to stay in your home without making mortgage payments:

Reach out for help from a certified housing counselor. A qualified housing counselor can help you understand your rights and responsibilities as a homeowner, create a budget plan that fits your current situation, evaluate your options for loan modification or refinancing, and provide guidance on how to negotiate with lenders.

File for forbearance or deferment if eligible. During times of hardship, such as job loss or medical emergency, it may be possible to request a moratorium on mortgage payments via forbearance or deferment programs offered by lenders.

Negotiate with lenders for loan modification programs. Your lender may have different loan modification programs available, which could lower monthly payments and extend repayment plans so that you can pay off the loan over time without going into default.

Refinance your existing mortgage loan at lower interest rates. If possible, try to refinance your existing loan at lower interest rates so that the monthly payments become more manageable and affordable for you in the long run.

Explore other alternatives, such as short sales or deed-in-lieu offers. In some cases, lenders may accept offers from potential buyers who are willing to buy the property through short sale programs or agree with homeowners who offer their deed instead of full payment (deed-in-lieu).

| JUDICIAL FORECLOSURE | REORGANIZATION BANKRUPTCY | BANKRUPTCY PETITION | BANKRUPTCY LAW | HOME MORTGAGES | MORTGAGE LENDER |

| HOME LOAN | LOAN AMOUNT | PROPERTIES | LAWYERS | LAWSUIT | LITIGATION |

| CASH | THE UNITED STATES | U.S. | CHAPTER 7 LIQUIDATION | AUCTION | CONTRACT |

| TRUSTEE | LAW FIRM | DEED-IN-LIEU-OF-FORECLOSURE | FINANCIAL CRISIS | KANSAS CITY MO |